New York

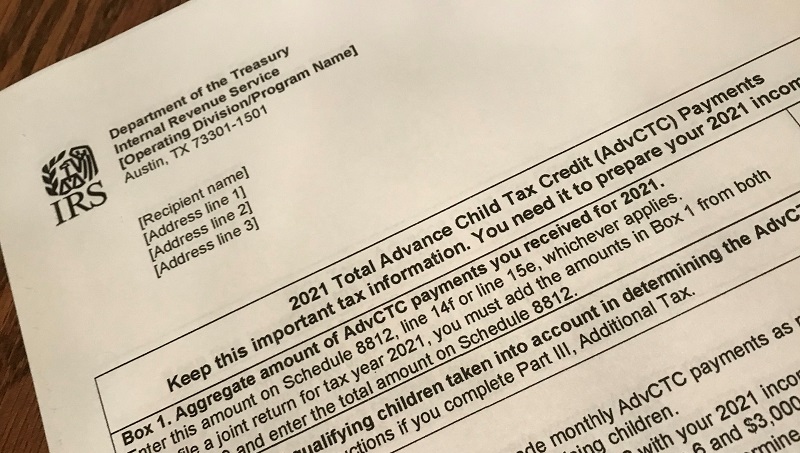

Parents receiving child tax credit need Letter 6419 when filing taxes

New York – Parents who have received the third round of child tax credit payments from the government last month will need what’s known as Letter 6419 when they file their taxes this year.

By the end of the week, the letter should be getting to recipients.

Letter 6419 will help accurately report the amount of money parents received upfront in 2021.

Families received up to $300 for each child age 5 and under and $250 for children ages 6-17.

The credits were paid out between July and December.

You can call the IRS at 800-908-4184 if you received tax credits for children and don’t receive the letter.